Effortlessly accept in-person payments with Tap to Pay

Getting paid can be one of the biggest challenges for self employed people but with Tidy’s Tap to Pay feature, getting paid as soon as the job’s done, and tracking payments has never been simpler.

Whether you’re a tradesperson, sole trader, or small business owner, Tidy’s mobile payment solutions offer fast, secure ways to take payments and track your earnings – in our all-in-one, user-friendly app.

With Tap to Pay, you can take in-person payments directly from your phone; no need to carry a bulky payment terminal or sign up for a contract. Tidy makes it easy to set up – in just a few clicks, you’re set to take payments, keeping your cash flow steady and your business running smoothly.

How Tidy makes tracking payments simple with Tap to Pay

1. Quick and easy payment tracking

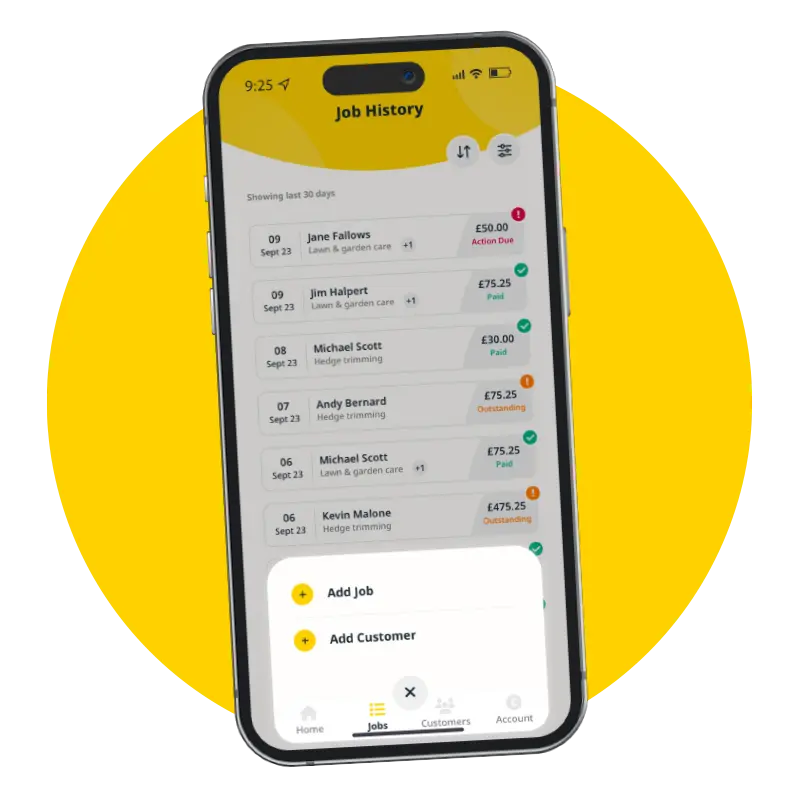

Tidy’s integration with Tap to Pay allows you to track payments in real time. With every transaction, your earnings are updated immediately, providing a live overview of what you’ve earned, what’s paid, and what’s still outstanding, prompting you to chase any overdue payments.

2. Instant transactions for faster cash flow

With Tap to Pay, payments are processed instantly, which means money is transferred to your account quickly. Once you’re an established user, Stripe ensures faster payouts, improving your cash flow and helping you stay on top of your finances. Tracking payments has never been easier, as all transaction data is automatically recorded in Tidy, making your accounting processes easier.

3. Simplified Payment Process

Setting up Tap to Pay is straightforward with Tidy’s step-by-step guide. In just a few clicks, you’ll be ready to start accepting in-person payments on your mobile. Whether you’re at a customer’s home, at a job site, or on the go, you can take in-person payments without needing additional hardware or complicated systems.

Benefits of using Tap to Pay for tracking payments

1. No need to carry a payment terminal or sign a contract

Tidy’s Tap to Pay feature eliminates the need for bulky and expensive card readers and long-term contracts. You can start accepting payments with just your smartphone, streamlining the payment process for you and your customers.

2. Track payments automatically

With mobile payment options like Apple Tap to Pay and Google Pay, your transactions are recorded, which saves time with your accounting processes – no need to list payments manually – tracking payments has never been more convenient.

3. Secure and fast transactions

Tidy ensures that all transactions processed through Tap to Pay are encrypted, safeguarding both you and your customers from fraud. With secure payment tracking, you can rest easy knowing that your business and financial data are protected. It also demonstrates a more tech-savvy approach to your customers.

4. Flexible payment options

Tap to Pay can offer your customers the option to pay in instalments through Klarna. Providing your customers with more flexible payment optionscan give your business a competitive edge.

5. Digital receipts and reports

One of the key advantages of Tap to Pay is the ability to generate digital receipts and financial reports automatically.

This reduces paperwork, improves your record-keeping for accounting purposes, and helps you stay organised when it’s time for tax reporting or financial planning.

6. Digital admin streamlines your accounting

Get started with Tap to Pay and track payments seamlessly

STEP 1

Download the Tidy App

Simply download the Tidy app and log in with our magic link – no passwords required.

STEP 2

Set up in minutes

Follow our easy setup process, including activating Tap to Pay – you’ll be able to start accepting in-person payments on your phone in minutes!

STEP 3

Start tracking payments

Add customers, schedule jobs, send invoices, and start accepting payments. Payments will be tracked, and Tidy will keep an eye on what’s been paid and what’s overdue.

Why choose Tidy for tracking payments?

Benefits of digital payment tracking:

- Track payments in real time: See your earnings and outstanding payments instantly.

- Accept payments anywhere: Use Apple Tap to Pay or Google Pay to accept in-person payments on your smartphone.

- Boost cash flow: With faster payment processing, you’ll get paid quickly, keeping your cash flow steady.

- Improve efficiency: Tidy simplifies your payment process, reduces paperwork, and enhances your customer experience.