How much does it cost to use the Tidy App?

Tidy fees are charged on a Pay as You Go basis

The Tidy App provides a simple, cost-effective, and secure way for tradespeople and self-employed individuals to manage their business admin, including accepting payments via automated digital invoicing, or offering customers Tap to Pay on your phone.

The Tidy App charges 2.5% per transaction capped at £2.50 and up to a maximum of £20 per month. Tidy leverages Stripe for fast and secure payments and each transaction incurs a Stripe card processing fee, see below.

There is no subscription, or minimum contract, and with features like Tap to Pay, automated invoicing, seamless payment tracking, and the option to add a QuickBooks account for FREE, Tidy helps you stay organised, get paid on time, and keep your business running smoothly, and cost effectively. What’s more new users can try us FEE FREE for 3 months from sign up. Stripe fees will still apply.

No hidden fees

Tidy is all about keeping things as simple as possible and that includes our fees.

Tidy applies a 2.5% transaction fee each time you take a payment via the app.

Our transaction fees are capped at a maximum of £2.50 per transaction and £20 per month.

New users can try Tidy FEE FREE for 3 months from sign up. Card processing fees still apply.

£0

Monthly costs. No contract.

20p + 1.5%

Card processing fee per transaction.

2.5%

Tidy platform fee per transaction.

Integrate a QuickBooks account for FREE!*

*Tidy integrates with QuickBooks and includes the cost in our 2.5% transaction fee – we call this Pay as You Go accounting!

Get in touch for more information by emailing us at [email protected] or calling 03330 38 48 98.

How much does using Tidy to take payments cost?

Using the Tidy App is affordable and cost-effective, especially considering how much time and effort it saves you in managing your business. By managing your cashflow better, you may save on bank charges. If you integrate your Tidy account with an accounts package, we cover the monthly fee and you can keep your accountants bills to a minimum, or file your accounts yourself.

There are no hidden charges or long-term contracts – just a straightforward Pay as You Go system.

Tidy App & card processing fees:

- Platform fee: For each payment accepted via the Tidy App, a small platform fee of 2.5% applies. This fee is capped at £2.50 per transaction, and at a maximum of £20 per month.

- Card processing fee: Tidy leverages Stripe for secure transaction processing. Stripe applies a card processing fee of: 0.20p + 1.5% per transaction for standard card payments.

- Cash payments: Cash can be logged in the app for free - only digital transactions incur processing and platform fees.

- Pay as You Go accounting: Integrate your Tidy account with a new or existing QuickBooks account and Tidy covers the cost. So you only pay your transaction and card processing fee each time you accept a payment: QuickBooks is included for FREE!

Examples of Tidy App Fees:

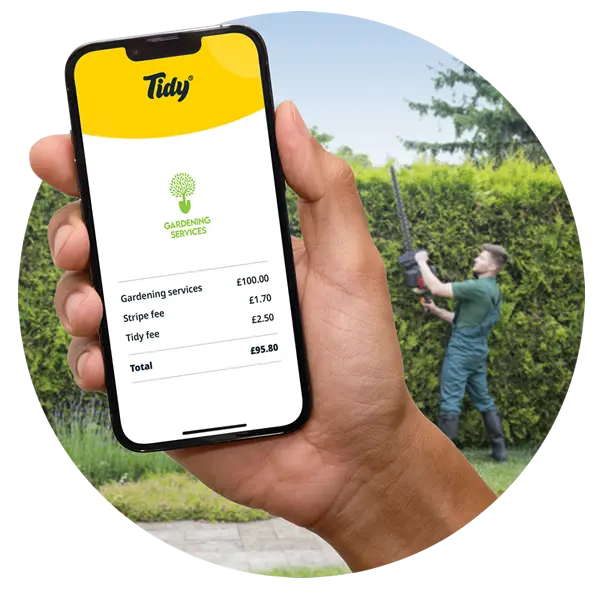

If you receive £100 via the Tidy App, your total fees will be £4.20 (£2.50 Tidy platform fee + £1.70 card processing fee).

For a £1,000 payment, your fees will be £17.70 (£2.50 Tidy platform fee + £15.20 card processing fee).

We cap our Tidy platform fees at £20 per month – so you know you will never pay more than that.

Card processing fees apply to all transactions and are in addition to the Tidy platform fee.

Here’s the simple facts and figures in a nutshell:

- Tidy makes a small charge each time you get paid via the Tidy App - this excludes logging cash payments.

- The Tidy platform fee is 2.5% per transaction for using our payment options, capped at £100 - so a maximum of £2.50.

- We cap our Tidy fees at a maximum of £20 per month.

- Tidy leverages Stripe for secure transaction processing. Stripe charges a card processing fee of 0.20p + 1.5% per transaction. (Standard cards).

- There is no minimum term, no contract, Tidy operates on a Pay as You Go basis.

Take control of your cash flow with Tidy

Tidy gives you the tools to take charge of your cash flow and streamline your admin. Tidy automatically generates smart, digital invoices for each job, tracks your cash flow with our handy Account Summary tool, and chase and take payments more easily. Get started today and transform the way you handle business admin.